Why Baltimore Homeowners Are Confused by Zillow Estimates

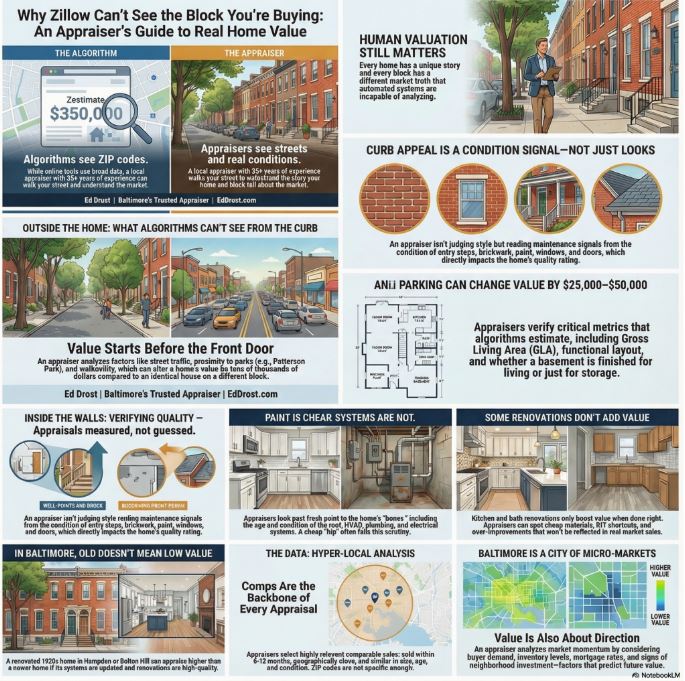

If you've ever looked up your Baltimore home on Zillow and wondered why the Zestimate doesn't match what an appraiser told you, you're not alone. This confusion occurs daily across Baltimore City and Baltimore County and stems from a fundamental mismatch between how algorithms operate and how Baltimore's real estate market actually functions.

The core issue is simple: Baltimore is not a ZIP-code market. It's a block-by-block city where value can shift dramatically within a few hundred feet. Online estimates treat neighborhoods as uniform zones, but anyone who knows Baltimore understands that the block matters more than the boundary.

I'm Ed Drost, a Maryland State Licensed-Certified Residential Appraiser with over 35 years of experience in Baltimore City and Baltimore County. I've appraised thousands of properties in neighborhoods from Federal Hill to Hamilton, and I've seen firsthand why automated tools struggle with our unique market dynamics.

What Is a Zillow Zestimate? How Automated Valuation Models Work

A Zillow Zestimate is an Automated Valuation Model (AVM) that uses publicly available data to estimate home values. The system pulls information from multiple sources to generate a number, but it's important to understand what goes into that calculation and what doesn't.

Zestimates rely on:

Public property records (lot size, square footage, year built)

Recent sales data in the general area

Tax assessment information

Basic property characteristics like bedroom and bathroom counts

Here's what Zestimates cannot do:

Physically inspect the property — No one visits your home

Assess actual condition — The algorithm can't see your roof, HVAC, or foundation

Review mechanical systems — Plumbing, electrical, and structural issues remain invisible

Apply block-level nuance — The system treats entire neighborhoods as similar zones

This limitation matters significantly in Baltimore, where micro-variations in condition and location drive real value.

What Is a Professional Appraisal in Baltimore? How Appraisers Determine True Market Value

A professional appraisal involves a certified appraiser physically visiting your property and conducting a comprehensive evaluation. This isn't an automated process; it's verification, not automation.

During a Baltimore appraisal, I examine:

Interior and exterior condition through on-site inspection

Verified Gross Living Area (GLA) with actual measurements

Major systems: roof condition and age, HVAC equipment, plumbing functionality, electrical panel capacity

Functional utility: layout efficiency, bedroom and bathroom count, and basement finish quality

Parking availability and configuration

Block-level comparable sales from the immediate micro-market

The difference between an algorithm and an appraiser is the difference between data processing and professional judgment based on physical evidence. An appraisal provides what a Zestimate cannot: eyes-on verification of what buyers actually pay for in Baltimore's complex market.

Why Baltimore Breaks Algorithms: Understanding Baltimore's Micro-Markets

Baltimore's real estate market operates on a hyper-local level that confounds ZIP-code-based valuation models. What works in suburban markets with uniform subdivisions fails in a city where value changes block by block.

Consider these local examples that algorithms miss:

Federal Hill vs Riverside: These neighborhoods share ZIP code 21230, but Federal Hill commands significantly higher prices due to its walkability, high amenity density, and buyer demand.

East vs South of Patterson Park: The eastern blocks have seen substantial investment and gentrification, while the southern blocks remain transitional. Same park, different markets.

Hampden near The Avenue vs outer blocks: Proximity to "The Avenue" in Hampden creates premium values. Move three blocks away, and you're in a different price tier.

Canton interior blocks vs busy corridors: Quiet interior streets in Canton sell at premiums over properties on O'Donnell Street or Boston Street, despite similar square footage.

This block-by-block variation is why I spend significant time analyzing where properties sit within their neighborhoods, not just which neighborhood they're in. A Zestimate treats these distinctions as noise in the data. An appraiser treats them as the signal.

Condition vs Appearance: Why Paint Photographs Well — and Roofs Don't

One of the most common Zestimate disconnects happens when a property looks great in photos but has underlying issues that affect market value. Fresh paint, modern fixtures, and staged interiors create visual appeal that listing descriptions and algorithms reward. But buyers and their home inspectors dig deeper.

What algorithms can't see:

Roof age and condition — A 20-year-old roof might need replacement within 2-3 years, representing $8,000-$15,000 in immediate cost

HVAC system age — A furnace or AC unit near the end-of-life means $4,000-$8,000 in upcoming expense

Electrical panel capacity — Older 100-amp panels or Federal Pacific panels require costly upgrades

Plumbing issues — Galvanized pipes, cast iron stacks, or polybutylene systems present replacement costs

Structural concerns — Foundation settling, brick deterioration, or framing issues that photos don't reveal

Professional appraisers adjust value based on these factors because we know buyers negotiate for them or walk away when inspection reports surface major deferred maintenance. A cosmetically updated rowhouse with a failing roof isn't worth the same as one with all systems up to date, even if both look identical online.

The Baltimore Parking Premium: How Parking Can Change Value by $25,000–$50,000

In rowhome neighborhoods across Baltimore, parking isn't just a convenience; it's a major value driver that algorithms consistently underestimate. This is particularly true in high-demand areas where on-street parking is scarce and competitive.

Areas where parking premiums are highest:

Canton — Properties with deeded parking pads or garage spaces command $30,000-$50,000 premiums over comparable homes without parking

Federal Hill — Off-street parking adds $25,000-$40,000 in the core neighborhood blocks

Fells Point — Limited on-street availability makes private parking spaces highly valuable

Locust Point — Dense development and weekend congestion create strong parking premiums

Zillow's algorithm may indicate whether parking is available, but it can't measure how much buyers actually pay for it in specific micro-markets. I've seen identical rowhouses on the same block sell $40,000 apart based solely on parking configuration. That's not statistical noise; that's real buyer behavior that requires local market knowledge to quantify accurately.

Comparable Sales — The Backbone of Every Appraisal: Why ZIP-Code Averages Don't Work

Every appraisal is built on comparable sales analysis, but the quality of those comparables determines the reliability of the valuation. This is where local expertise separates automated estimates from professional analysis.

Reliable comparable sales must be:

Recent — Typically from the past 6-12 months to reflect current market conditions

Geographically close — Within the same micro-market, often the same block or immediate surrounding blocks

Similar in characteristics — Comparable size, age, condition, layout, and features

A home in Hampden isn't automatically comparable to one in Remington, even if they're geographically nearby. The neighborhoods have different buyer profiles, access to amenities, and price structures. I've seen appraisers from outside Baltimore make this mistake, and it produces unreliable valuations.

ZIP-code averages fail in Baltimore because they blend dissimilar properties into statistical composites. A Zestimate might average sales from across Federal Hill, mixing interior blocks with waterfront properties, renovated homes with fixer-uppers, parking-rich properties with those that have none. The result is a number that doesn't reflect what a specific property would actually sell for in the current market.

The Value Gap: Why $20,000–$40,000 Differences Are Common

When homeowners compare their Zestimate to their appraisal and find a $20,000, $30,000, or even $40,000 difference, they're often shocked. But in Baltimore's market, these gaps are common and predictable.

The most significant discrepancies occur with:

Transitional blocks — Areas experiencing gentrification where algorithms lag behind rapidly changing buyer demand

Distressed properties — Homes needing substantial work that look similar to renovated comps in automated systems

Newly renovated homes — Properties where recent updates haven't been captured in public records or tax assessments

Unique configurations — Properties with unusual layouts, additions, or conversions that don't fit standard models

Who does this impacts most:

Buyers risk overpaying if they rely on Zestimates for offer amounts

Sellers may underprice or overprice their homes without accurate valuation

Investors can miscalculate ROI and acquisition strategies

Homeowners need accurate values for refinancing, tax appeals, or estate planning

Understanding these gaps matters because real estate decisions carry real financial consequences. A $30,000 overestimate can mean the difference between closing a purchase and walking away when the appraisal comes in low.

Zestimate vs Appraisal — When to Use Each: The Right Tool for the Right Decision

Use a Zestimate for:

Early market curiosity about your neighborhood

Casual browsing of properties you might be interested in

Rough ballpark figures when you're just starting to think about selling

General awareness of whether your area is trending up or down

Rely on a professional appraisal for:

Buying a home (lenders require it for a reason)

Selling your property (accurate pricing matters)

Refinancing to get better terms or access equity

Tax appeals to challenge inflated assessments

Divorce settlements where precise valuation is required

Estate matters and inheritance distribution

Investor due diligence before acquisition

The investment in a professional appraisal pays for itself when it prevents a $20,000 pricing error or identifies $30,000 in deferred maintenance that would have surprised you at inspection.

Why Local Expertise Matters in Baltimore: Verification Beats Automation

Technology has its place in real estate, but it can't replace the value of walking a block, understanding buyer behavior patterns, recognizing neighborhood trends, and physically examining property condition. This is especially true in a market as granular as Baltimore.

Local expertise means:

Knowing which blocks in a neighborhood command premiums and why

Recognizing architectural details that signal quality or concerns

Understanding how recent development projects affect surrounding values

Identifying transitional zones before the data reflects the change

Seeing condition issues that affect buyer's willingness to pay

In a block-by-block city like Baltimore, local expertise isn't optional; it's essential. I've appraised properties where two identical rowhouses three doors apart sold for $35,000 at different prices because one had parking and updated systems, while the other needed immediate capital investment. An algorithm would miss that distinction. A local appraiser sees it immediately.

Get the Value Zillow Can't See

Zillow Zestimates serve a purpose as general reference points, but they're not substitutes for professional valuation in Baltimore's complex, micro-market-driven real estate landscape. The algorithms that work reasonably well in uniform suburban markets struggle with the block-by-block variations that define value in our city.

When your financial decision requires accuracy—whether you're buying, selling, refinancing, or challenging a tax assessment—trust the verification process that appraisers provide. We see what algorithms can't: actual condition, real comparable sales from your specific micro-market, and the neighborhood nuances that determine what buyers actually pay.

Baltimore's real estate market rewards local knowledge and penalizes assumptions. Make sure your next real estate decision is based on both.

Author Authority

Ed Drost | Baltimore's Trusted Appraiser

Maryland State Licensed-Certified Residential Appraiser

35+ Years of Local Experience in Baltimore City & Baltimore County

Specializing in Historic Properties, CHAP Tax Credits, and Micro-Market Analysis

EdDrost.com

Frequently Asked Questions

Q: How accurate are Zillow Zestimates in Baltimore?

A: Zillow reports a median error rate, but in Baltimore's block-by-block market, individual property estimates can vary significantly from market value. Differences of $20,000-$40,000 are common, especially in transitional neighborhoods or properties with unique features.

Q: Why is my Zestimate higher than my appraisal?

A: Zestimates often miss condition issues, deferred maintenance, or negative location factors within a micro-market. They may also use comparables from different blocks that aren't truly similar to your property.

Q: Why is my appraisal higher than my Zestimate?

A: This happens when algorithms undervalue parking, recent quality renovations, or positive micro-market positioning. Appraisers see features and location advantages that automated systems don't capture.

Q: Can I use a Zestimate for a home purchase offer?

A: Zestimates are helpful starting points, but offers should be based on comparable sales analysis and consideration of actual condition. Relying solely on a Zestimate can lead to overpaying or losing a deal when the appraisal comes in lower.

Q: Do appraisers look at Zillow when doing valuations?

A: Professional appraisers don't use Zestimates in their analysis. We use verified comparable sales, physical inspection findings, and market data to independently determine value.

Q: How much does a residential appraisal cost in Baltimore?

A: Residential appraisals typically range from $400-$600, depending on property size, complexity, and location. This investment provides verified, defensible value analysis for significant financial decisions.

Q: What's the difference between a Zestimate and a tax assessment?

A: Both are automated estimates, but they serve different purposes. Tax assessments determine property tax liability and may lag behind market values. Zestimates attempt to predict the current market value. Neither replaces a professional appraisal for accuracy.

Q: How often do Zestimates update?

A: Zillow updates Zestimates regularly as new data becomes available, but in rapidly changing micro-markets like Baltimore's transitional neighborhoods, these updates may not capture real-time market shifts that local appraisers recognize immediately.

Ed Drost is a Certified Residential Appraiser with more than 35 years of hands-on experience valuing residential properties throughout Baltimore City and Baltimore County. Known as Baltimore’s Trusted Appraiser, Ed specializes in accurate, defensible appraisals for homeowners, buyers, attorneys, lenders, and real estate investors navigating Baltimore’s block-by-block market. His work emphasizes valuation integrity, risk assessment, and local market precision—especially in cases where automated estimates fall short. Ed’s appraisals are USPAP-compliant, inspection-based, and grounded in verified comparable sales and real-world market behavior. Learn more at EdDrost.com.

- Dec 20, 2025

Zestimate vs Appraisal in Baltimore: Why Online Estimates Miss the Mark in a Block-by-Block City

- Ed Drost

- Baltimore's Appraiser

- 0 comments